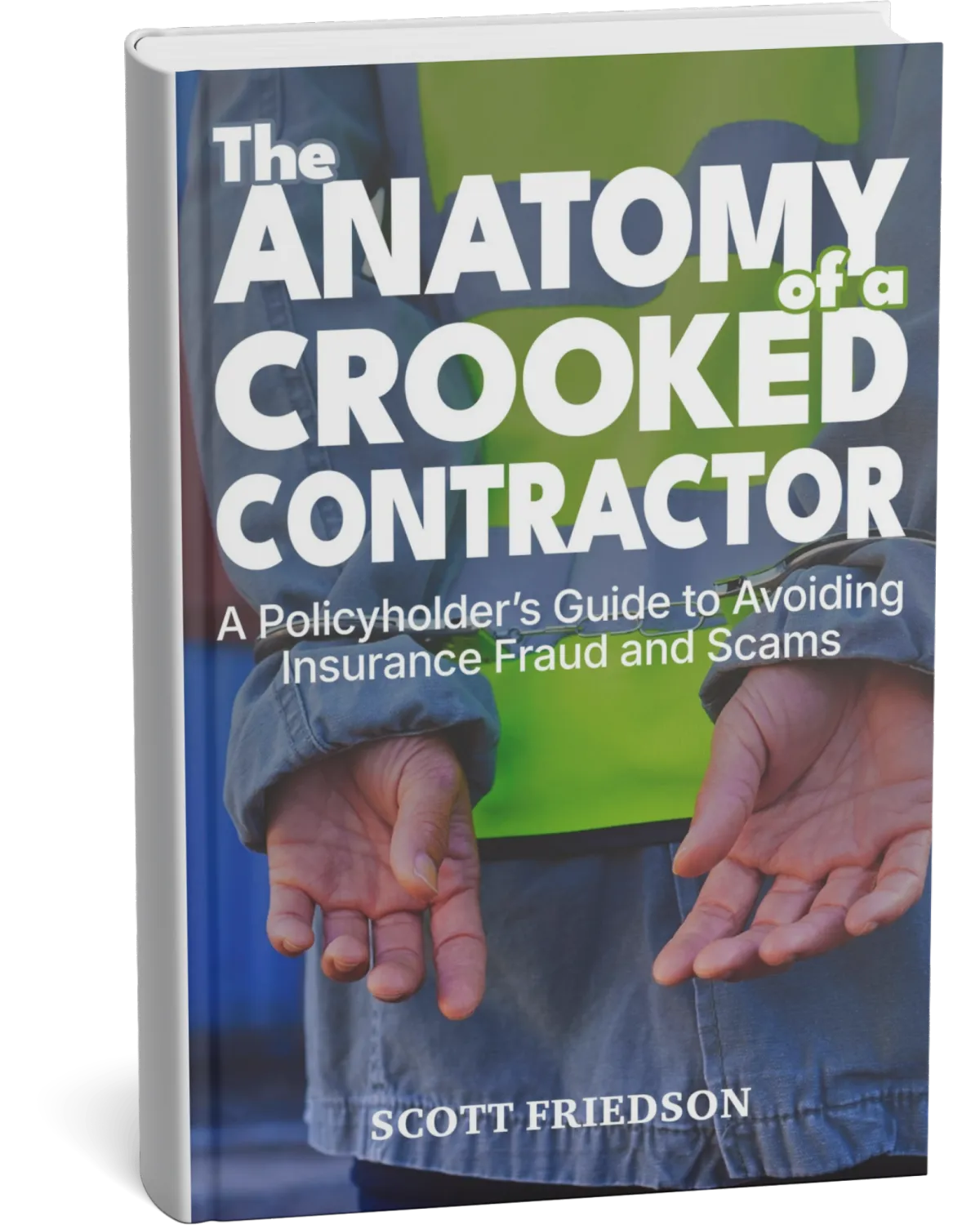

ATTENTION: Home & Business Policyholders

Stop a Crooked Contractor Before They Cost You Thousands

DOWNLOAD FREE guide to protect you from

Insurance Claim Fraud and Scams.

Don't Let a Crooked Contractor Ruin Your Recovery.

ATTENTION: Home & Business Policyholders

Stop a Crooked Contractor

Before They Cost You Thousands

DOWNLOAD FREE guide to protect you from Insurance Claim Fraud and Scams. Don't Let a Crooked Contractor Ruin Your Recovery.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

What You'll Learn - Highlights

Red Flags: How to Spot a Crooked Contractor

Checklist: How to Choose a Reputable Contractor (Licensed or Unlicensed)

Understanding Insurance Fraud: What Policyholders Need to Know

Line-Item vs. Lump Sum Estimates: Why It Matters

UPPA: Why the Unauthorized Practice of Public Adjusting matters for Policyholders

Prevent permit problems, hidden costs, and shoddy workmanship.

Ensure your insurance claim repair estimates are credible.

Confidently vet contractors:

Ensuring you’re working with reputable professionals.Understanding Insurance Fraud: Waiving Deductibles & More

Red Flags:

How to Spot a Crooked ContractorChecklist:

How to Choose a Reputable Contractor (Licensed or Unlicensed)Understanding Insurance Fraud:

What Policyholders Need to KnowLine-Item vs. Lump Sum Estimates: Why It Matters

UPPA:

Why the Unauthorized Practice of Public Adjusting matters for PolicyholdersPrevent permit problems, hidden costs, and shoddy workmanship.

Ensure your insurance claim repair estimates are credible.

Confidently vet contractors:

Ensuring you’re working with reputable professionals.Understanding Insurance Fraud:

Waiving Deductibles & More

Red Flags:

How to Spot a Crooked ContractorChecklist:

How to Choose a Reputable Contractor (Licensed or Unlicensed)Understanding Insurance Fraud:

What Policyholders Need to KnowLine-Item vs. Lump Sum Estimates: Why It Matters

UPPA:

Why the Unauthorized Practice of Public Adjusting matters for PolicyholdersPrevent permit problems, hidden costs, and shoddy workmanship.

Ensure your insurance claim repair estimates are credible.

Confidently vet contractors:

Ensuring you’re working with reputable professionals.Understanding Insurance Fraud:

Waiving Deductibles & More

The Anatomy of a Crooked Contractor is the most complete, tactical guide ever written for policyholders to help identify and avoid contractor scams and schemes. It’s designed to help:

Homeowners

HOAs

Condominium Associations

Townhome Communities

Apartment Building Owners & Operators

Property Management Companies

Religious Organizations & Nonprofits

Commercial Building Owners

Schools

Why You Need This Guide

If you own or manage residential or commercial property… this guide is not optional.

From single-family homes to high-rise apartment buildings, if a storm or fire has damaged your property — you’re now in a legal, financial, and emotional battle with your insurance company.

And they have a strategy: Underpay, Delay, Deny, Defend.

You need one too.

Whether you’re facing roof damage, water intrusion, business interruption, or total fire loss, this guide arms you with the knowledge to fight back — with truth, tools, and the support of licensed professionals.

What Else You’ll Discover Inside...

Why Crooked Contractors Are a Serious Risk

How Crooked Contractors Operate – Red Flags to Watch For

Checklist: How to Vet a legitimate Contractor

What is Insurance Fraud? – Common Examples & Tactics

Deductible Laws by State – Where Waivers Are Illegal

State-by-State Insurance Fraud Penalties

As a leading public adjusting firm with 20+ years of experience, 500+ large-loss claims settled, and a proven track record of delivering powerful results for policyholders like you who deserve clarity and protection before hiring a contractor.

Know Your Policyholder Rights

Insurers are required by law to act in good faith

They must equally consider any evidence supporting your position

You have the right to file a bad faith claim if they wrongfully delay, underpay, or deny

You’re entitled to indemnity—restoration of your property and financial loss

You bear the burden to prove your claim damages. This means if you don’t prove your loss, they don’t have to pay.

Why Hiring a Public Adjuster May Be Crucial

When your property is damaged, insurance companies bring in expert, adjusters, engineers, attorneys, to protect their bottom line. You should too.

A qualified public adjuster:

Advocates only for you, not the insurer

Helps you understand and comply with your policy

Fights lowball offers and wrongful denials

Increases your payout by up to 747%, according to Florida OPPAGA Study

Frequently Asked Questions

What types of claims do you handle?

Wind and storm damage

Hail and roof failure

Fire and smoke damage

Flood and water intrusion

Mold, collapse, theft

Business interruption and ALE (loss of use)

Who is this guide for?

Homeowners

Condo associations

HOAs

Commercial building owners

Churches, schools, and religious groups

Apartment complexes and property managers

Nonprofits with insured property

Why can’t I just trust the insurance company adjuster?

Because they work for the insurer — not you. Their job is to minimize what’s paid. You need your own advocate.

What’s the biggest mistake policyholders make?

Accepting the first settlement or waiting too long. Delays can ruin your ability to get paid fairly.

Your Rights as a Policyholder

Insurers are required by law to act in good faith

They must equally consider any evidence supporting your position

You have the right to file a bad faith claim if they delay, underpay, or wrongfully deny

You’re entitled to indemnity—restoration of your property and financial loss

You bear the burden of proving your claim damages. This means if you don’t prove your loss, they don’t have to pay.

Frequently Asked Questions

What types of claims do you handle?

Wind and storm damage

Hail and roof failure

Fire and smoke damage

Flood and water intrusion

Mold, collapse, theft

Business interruption and ALE (loss of use)

Who is this guide for?

Homeowners

Condo associations

HOAs

Commercial building owners

Churches, schools, and religious groups

Apartment complexes and property managers

Nonprofits with insured property

Why can’t I just trust the insurance company adjuster?

Because they work for the insurer — not you. Their job is to minimize what’s paid. You need your own advocate.

What’s the biggest mistake policyholders make?

Accepting the first settlement or waiting too long. Delays can ruin your ability to get paid fairly.

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Stop guessing. Stop waiting. Start recovering.

Get The Anatomy of a Crooked Contractor and become the most informed, empowered, and protected policyholder in the claims process.

“Blessed is the policyholder who is prepared, for they shall inherit a full and fair settlement.”

TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.